‘Wise consumption is a far more difficult art than production’. John Ruskin

1 Ecology and culture

Ways of thinking based on the assumption that human beings hold a privileged or central position in the social evaluation of our use of natural resources are on the sidelines of radical environmental politics. However, future historians may well look upon the years 1978-80 as a revolutionary turning point in the world’s social and economic history towards rectifying this. It was certainly a time when the relationship between culture and environment entered the political discourse regarding the future course of world development.

Four significant political events acted like epicentres in the unfolding of the transformation of the post war economic order: in 1978, Deng Xiaoping took the first steps toward liberalising the Chinese economy; in 1979, Paul Volcker took command of the US Federal Reserve and changed monetary policy, whilst in that same year Margaret Thatcher took on the power of the unions and pledged to end inflationary stagnation with a burst of neo-liberalism. In 1980, Ronald Reagan was elected President of the USA, and armed with Volcker’s policies, set about implementing a set of reforms that were aimed at curbing union power, deregulating industry, and creating more liberal conditions for finance to operate freely on the national and the global stages.

“From these several global epicentres, revolutionary impulses seemingly spread and reverberated to remake the world around us in a totally different image” (Harvey, 2005).

The distinction between ecologism and environmentalism now has a wide currency among ecologists. Indeed, it was already in being when ‘The Ecologist’ published an editorial entitled ‘Down with Environmentalism!’ In 1972. As Jonathon Porritt and David Winner argued at the time when the term was gaining wider recognition, ecologism is radical for it seeks nothing less than a non-violent revolution to overthrow our whole polluting, plundering and materialistic industrial society. The economic system was portrayed as dehumanising, making decisions on the basis of profitability rather than human need: a revolutionary argument that was played out most dramatically in the UK 1980s coal miner’s strike.

The revolution that E.F. Schumacher advocated in his book ‘Small is Beautiful’‘, was a people-centred economics because that would, in his view, enable environmental and human sustainability. Accordingly, the term ‘ecologism’ applies to positions that are both more radical and more complex than environmentalism.

Andrew Dobson is keen to distinguish between environmentalism and ecologism. His standpoint is that environmentalists do not necessarily subscribe to the limits to growth thesis, nor do they typically seek to dismantle industrialism. They are likely to argue for the intrinsic value of the non-human environment but would balk at any suggestion that we as a species require ’metaphysical reconstruction’ as proposed by Schumacher. Environmentalists will typically believe that technology can solve the problems it creates and they will probably regard any suggestions that only frugal living will provide for sustainability as wilful nonsense. Dobson therefore makes the point that what passes for green politics in the pages of today’s newspapers is the philosophy of environmentalism, not the ideology of political ecology properly understood’ and distinguished by the term ecologism.

However, both Schumacher and Dobson fail to specify the institutions required to support the controlled metaphysical reconstruction demanded by ecologism.

The economist, James Robertson has no such qualms. His first involvement with practical political economy covered the period from 1957, and Prime Minister Macmillan’s ‘never had it so good’ speech, to working as a civil aide on Macmillan’s 1960 ‘wind of change’ African tour, which kick started decolonisation. He was witness to the rapid unravelling of the post War economic boom and the failure of the following labour administration to halt the boom bust cycle.

2 Robertsonian economics

Roberson says that the 20th century showed that a centralised socialist economy cannot work efficiently, justly or ecologically. On the other hand, the idea of a free market economy based on objective prices that can continue for ever is a fantasy. His view is that we need to rediscover the purpose of money, which ought to be to facilitate fair participation in the production and exchange of goods and services, within the planet’s capacity. His stance is that it is our money system that is propelling us toward self-destruction. Further, he proposes how it could be gently reformed so that it acts for the benefit of people and society rather than the opposite, and describes the obstacles that currently prevent that reform.

“If we were now starting from scratch to arrange how money should be supplied to a democratic society,” Robertson says, “nobody in their right mind would dream of setting it up as it is right now.” What they would not dream of doing is creating the money supply by giving private banks the authority to create money out of thin air and put it in their customers’ bank accounts as a loan on which they are obliged to pay interest. In this way roughly 97% of the money circulating in the economy passes into the bank accounts of other customers while we are using the original loans to do our business. Further, as we do our business we pay interest to the bank as we are also repaying the capital.

“When customers repay their loans to their banks, the banks write off the money and return it to the ‘nothing’ from which they had originally created it. But the money that has been paid on it as interest remains in existence as the property of the banks. This makes it continually necessary for enough money to be lent into existence to replace both what was originally lent but has now been written off, plus what has gone into the banks as interest on it. Otherwise there will not be enough money in circulation to support the non-financial activities of the economy.”

In summary, to maintain the banking system the economy must grow continually and it must continually expand (economic growth) to keep up. Moreover, because this arrangement requires people and businesses to continually take out loans from the bank, it automatically causes rising indebtedness in societies.

“You don’t have to be the proverbial rocket scientist—or even a professional economist or statistician,” says Robertson, “ to figure out who, apart from the banks themselves, will benefit most from increasing indebtedness in society and who will suffer most. In general, those who benefit most will be people and businesses with enough spare money to lend or invest it and get back more money for doing so. Those who suffer most will be those who have to borrow money at interest, and so pay more in order to meet the needs of themselves and their families. In short, the present way of providing the money supply systematically works to increase poverty and widen the gap between rich and poor.”

Robertson then goes on to point out that in addition to creating economic and social inequality, the current system, because it requires growth in debt and growth in economic production, “has the general effect of making us earn our living by extracting and wasting more of the Earth’s resources than would otherwise be needed.”

Robertson makes a final point about the problem of allowing the banks to be the prime source of money creation. This essentially allows the banks to decide how the money they create will be used on its first entry into circulation, which leads to problems like excessive lending for speculative purposes (like land and buildings), and ignoring projects that have a high long-term value to society (like preventive health and public services).

So the framework provided by the state institutions that deal with money must be redesigned to encourage ways of using money that serve, not damage, the interests of citizens now and in the future. Within such a new revolutionary framework:

- The market economy, freely responding to money values, would tend to deliver outcomes which combine economic efficiency with social justice and environmental care;

- The government would be able to let the market economy operate more freely, with less intervention than most economies today; and

- Citizens, who wished to do so, would find it easier than now to reduce their need for goods and services bought from the market economy, and also therefore to reduce the amount of money they need to earn by working as employees.

The state’s new role towards the market and the citizen should thus be to decolonise and empower. Robertson says that whether to call this a basically capitalist or basically socialist approach is a matter of personal choice. It will aim to integrate economic efficiency with economic justice. So you could call it both capitalist and socialist or neither, whichever you prefer.

3 Free lunches

Robertson firmly believes that Milton Friedman’s teaching that “there ain’t no such thing as a free lunch” is false. Starting with the enclosure of the common land, whether it be in an English village or the vast tracts of central Africa, modern economies have given massive free lunches to powerful individuals, organisations and also nations. In the sustainable way of doing things the value of these commons, as inputs to local economic activity, should be shared as a source of public revenue, to be divided between the local commoners in place of the economically, socially and environmentally damaging taxes we have now. This is the main principle of ecologism.

This will involve a shift from the idea of redistribution to the idea of predistribution. Whereas redistributive taxes aim to tap into the outcomes of economic activity, predistributive taxes and charges will share the value of essential inputs, ‘the commons’, to economic activity. Whereas redistribution is dependency-reinforcing, predistribution will be empowering. It will correct an underlying cause of economic injustice, inequality, exclusion and poverty.

In a globalised world economy, we need to evolve institutions of governance embodying those principles at supranational and subnational levels, as well as national level.

In particular, Robertson argues that we need to reform national money systems. He believes that governments should be at the heart of the money system by deciding (a) how the money supply should be created, (b) what is taxed and not taxed, and (c) what public expenditure is spent on and not spent on.

Concerning the money supply, he argues that the money creation should be transferred from commercial banks as a source of private profit for themselves to a public agency – the central bank – as a source of debt-free public revenue to be spent into circulation by the government for public purposes.

Robertson believes the practical key to sustainability lies in changing the tax system. In developed countries today taxation takes a third of the total value of the economy (GDP) out of some activities, and public spending puts it back selectively into others. The taxes add to the cost of what is taxed and the public spending subsidises the cost of what it supports. This affects relative prices all through the economy and does nothing to even out the distribution of wealth. Therefore, the price structure of any economy is bound to be skewed in favour of some things and against others. The proverbial ‘level playing field’ for investment and returns is a mirage.

For reforming taxation, he argues that we should;

- take taxes off incomes, profits, value added and other financial rewards for useful work and enterprise

- put taxes on to value subtracted by people and organisations for private profit from common resources (such as land) and from the environment’s capacity to absorb pollution and waste (such as carbon emissions); and

- reduce the present opportunities (through tax havens, etc) for rich people and businesses to avoid paying their dues to society.

4 Tragedy of the commons

In 1833 the English economist William Forster Lloyd published a pamphlet which included a hypothetical example of over-use of a common resource. This was the situation of cattle herders sharing a common parcel of land on which they are each entitled to let their cows graze, as was the custom in English villages. He postulated that if a herder put more than his allotted number of cattle on the common, overgrazing could result. For each additional animal, a herder could receive additional benefits, but the whole group shared damage to the commons. If all herders made this individually rational economic decision, the common could be depleted or even destroyed, to the detriment of all.

In 1968, ecologist Garrett Hardin explored this social dilemma in his article “The Tragedy of the Commons”, published in the journal Science. The essay derived its title from the pamphlet by Lloyd, which he cites, on the over-grazing of common land.

Hardin discussed commons in relation to the growing awareness of Earth’s loss of its ecosystem services. The loss of the commons cannot be solved by technical means, as distinct from those with solutions that require a change only in the techniques of the natural sciences, demanding little or nothing in the way of change in human values. Hardin also pointed out the problem of individuals acting in rational self-interest by claiming that if all members in a group used common resources for their own gain and with no regard for others, all resources would still eventually be depleted. Overall, Hardin argues against relying on conscience as a means of policing commons, suggesting that this favours selfish individuals – often known as free-riders – over those who are more altruistic. In the context of avoiding over-exploitation of common resources, Hardin concludes by restating Hegel’s maxim, “freedom is the recognition of necessity.” He suggests that “freedom” completes the tragedy of the commons. By recognizing resources as commons in the first place, and by recognizing that, as such, they require management, Hardin believes that humans “can preserve and nurture other and more precious freedoms.”

Hardin’s article was the start of the modern use of “Commons” as a shared resource term. Like Lloyd and Thomas Malthus before him, Hardin was primarily interested in the problem of human population growth. But in his essay, he also focused on the use of larger (though finite) resources such as the Earth’s atmosphere and oceans, as well as pointing out the “negative commons” of pollution (i.e., instead of dealing with the deliberate privatization of a positive resource, a “negative commons” deals with the deliberate commonization of a negative cost, pollution). The commons metaphor illustrates the argument that free access and unrestricted demand for a finite resource ultimately reduces the resource through over-exploitation, temporarily or permanently. This occurs because the benefits of exploitation accrue to individuals or groups, each of whom is motivated to maximize use of the resource to the point in which they become reliant on it. The costs of the exploitation are borne by all those to whom the resource is available (which may be a wider class of individuals than those who are exploiting it). This, in turn, causes demand for the resource to increase, which causes the problem to snowball until the resource collapses (even if it retains a capacity to recover). The rate at which depletion of the resource is realized depends primarily on three factors: the number of users wanting to consume the common in question, the consumptiveness of their uses, and the relative robustness of the common.

5 Modern commons

The tragedy of the commons can be considered in relation to environmental issues such as sustainability. The commons dilemma stands as a model for a great variety of resource problems in society today, such as water, forests, fish, and non-renewable energy resources such as oil and coal.

Actual situations exemplifying the “tragedy of the commons” include the overfishing and destruction of the Grand Banks, the destruction of salmon runs on rivers that have been dammed – most prominently in modern times on the Columbia River in the Northwest United States, and historically in North Atlantic rivers – the destruction of the sturgeon fishery – in modern Russia, but historically in the United States as well – and, in terms of water supply, the limited water available in arid regions (e.g., the area of the Aral Sea ) and the Los Angeles water system supply, especially at Mono Lake and Owens Lake.

In economics, an externality is a cost or benefit that affects a party who did not choose to incur that cost or benefit. Negative externalities are a well-known feature of the “tragedy of the commons”. For example, driving cars has many negative externalities; these include pollution, carbon emissions, and traffic accidents. Every time ‘Person A’ gets in a car, it becomes more likely that ‘Person Z’ – and millions of others – will suffer in each of those areas. Economists often urge the government to adopt policies that “internalize” an externality.

More general examples (some alluded to by Hardin) of potential and actual tragedies include:

Planet Earth’s ecology

-

- Uncontrolled human population growth leading to overpopulation

- Air, whether ambient air polluted by industrial emissions and cars among other sources of air-pollution, or indoor air

- Water -Water pollution, water crisis of over-extraction of groundwater and wasting water due to over-irrigation

- Forests – Frontier logging of old growth forest and slash and burn

- Energy resources and climate – Environmental residue of mining and drilling, Burning of fossil fuels and consequential global warming

- Animals-Habitat – destruction and poaching leading to the Holocene mass extinction.

- Oceans – Overfishing

- Antibiotics – Antibiotic Resistance Misuse of antibiotics anywhere in the world will eventually result in antibiotic resistance developing at an accelerated rate. The resulting antibiotic resistance has spread (and will likely continue to do so in the future) to other bacteria and other regions, hurting or destroying the Antibiotic Commons that is shared on a world-wide basis

Publicly shared resources

-

- Spam email degrades the usefulness of the email system and increases the cost for all users of the Internet while providing a benefit to only a tiny number of individuals.

- Vandalism and littering in public spaces such as parks, recreation areas and public rest-rooms.

- Knowledge commons encompass immaterial and collectively owned goods in the information age. Including, for example, source code and software documentation in software projects that can get “polluted” with messy code or inaccurate information.

6 Taxing the commons

James Robertson takes an economic view of commons as a collection of common resources whose value is due to Nature and to the activities and demands of society as a whole, and not to the efforts or skill of individual people or organizations’. Robertson gives as an example the sudden increase in the value of properties located near the Jubilee line on the London Underground after the route was published, an increase which he valued at £13 billion. Although land is the most obvious and important example of a commons there are others, of which the radio spectrum is one that is now the subject of government fees rather than taxation. EU governments raised considerable revenue by auctioning off the right to use various bandwidths, some £22.5 billion in the case of the UK government.

Such commons are shared resources, the bounty of nature, whose value should be shared. If it is to be exploited by a few then they should pay for that privilege. The Land Value Tax, or as Robertson refers to it, the ‘Land-Rent Tax’: is a tax on the annual rental site value of land. The annual rental site value is the rental value which a particular piece of land would have if there were no buildings or improvements on it. It is the value of a site, as provided by nature and as affected for better or worse by the activities of the community at large. The tax falls on the annual value of land at the point where it enters into economic activity, before the application of capital and labour to it.

A new approach is clearly needed, based on collecting the value of common resources as public revenue for the benefit of all citizens. Common resources are resources whose value is due to Nature and to the activities and demands of society as a whole, and not to the efforts or skill of individual people or organisations. Land is an obvious example. The value of a particular land-site, excluding the value of what has been built on it, is almost wholly determined by the activities and plans of society around it. For example, when the route of the London Underground Jubilee line was published, properties along the route jumped in value. Access to them was going to be much improved. So, as a result of a public policy decision, the owners of the properties received a £13bn windfall financial gain. They had done nothing for it; they had paid nothing for it; they had been given a very large free lunch. In 1994, based on 1990 values, it was calculated that the absence of a site-value tax on land was costing UK taxpayers £50bn to £90bn a year in lost public revenue

By contrast, the auction three years ago of twenty-year licences to use the radio spectrum for the third generation of mobile phones raised £22.5bn for the UK government. The governments of Germany, France and Italy also raised very significant sums from that common resource. Important common resources include:

- land (its site value)

- energy (its unextracted value)

- the environment’s capacity to absorb pollution and waste

- the use of limited space (e.g for road traffic, airport landing slots)

- water – for extraction and use, and for waterborne traffic

- the electro-magnetic (including radio) spectrum

- the value created by issuing new money – on which I shall say more.

The annual value of these is very great. Collecting it as public revenue would remove the need for many damaging existing taxes

Land tax

Greens share with libertarian economists a fondness for the land tax because of its extreme simplicity and efficiency. According to classical economists rents were to be eschewed since they encouraged decadence and idleness: increasing the value or quality of a piece of land, or producing something from it was to be encouraged; merely living from its wealth should be discouraged, preferably by high rates of taxation. This simplicity is the object of obfuscation by many writers on economics. Their argument is that economic rent cannot be quantified and hence is not a secure basis for taxation.

Richard Bramhall provides an amusing critique of their argument concluding that economists have ‘dumped a valuable fiscal tool on the scrap-heap of history, leaving the burden of tax to fall on labour and enterprise, while the landowner grows fat doing nothing’.

In today’s planning environment, where local authorities have the legal right to decide what land can be used for, vast quantities of value can be generated by the stroke of a computer keyboard, as when agricultural land undergoes a ‘change of use’ and becomes development land.

Those who argue for a land value tax claim that this value is democratically created and hence should be shared between all the citizens of the local authority. For many proponents of a land tax it can be a single tax, simply because of the vast sums it can generate.

Robertson’s calculation for the potential revenue from site-value tax on land in the UK was between £50 billion and £90 billion annually in 1994. Other taxes in the green economist’s knapsack can be justified on the basis of being taxes on commons. For example the streets of a thriving city belong to all; if only a few choose to use them for private transport then that right can be charged for and the proceeds shared with others through a congestion charge. By a similar argument the right to pollute the Earth’s atmosphere with greenhouse gases, causing economic disaster for others, should be paid for with a carbon tax.

7 The congestion charge

A carbon tax can be considered a ‘commons tax’, since it attempts to reduce behaviour that adds to the amount of CO2 pollution in the atmosphere, which is a shared commons. There are several variants of the scheme, but the basis of the tax is that it should be a unified tax on the carbon content of fuels to replace the complex array of fuel-related taxes that are in effect in many countries. Such a tax would provide a strong incentive for both businesses and individuals to reduce their energy consumption, their driving, and to switch to non-fossil-fuel heating as well as renewable electricity supply. In the mid-1990s the EC considered a proposal to introduce a carbon tax throughout the European Union. This was rejected, although Sweden, Finland, Norway, the Netherlands and Denmark introduced related taxes. The Swedish carbon tax achieved a reduction in CO2 emissions of 7 per cent, while the Danish energy tax resulted in a 10 per cent reduction in energy use.

Rather than taking a view that automobiles were polluting London’s atmospheric commons, the congestion charge in London was motivated more by irritation at the slow pace of traffic in the city than by environmental concern, but it has none the less been an important example of how taxation money can be redistributed locally in one of the world’s largest cities. By the 1990s traffic was moving more slowly in the UK’s capital than it had been at the beginning of the 20th century before cars had been invented! Following his election as mayor in 2000, Ken Livingstone launched an 18-month period of public consultation and the outcome was a decision to introduce a congestion charge based on area licensing rather than parking levies.

Considerable research and modelling were undertaken to predict the correct level of the charge to deter the desired number of people (30 per cent) from continuing to drive into the capital. In February 2003 a daily charge of £5 was introduced between 7.00am and 6.30pm on weekdays; this was increased to £8 in July 2005. Research had predicted that, at a rate of £5, car miles travelled in central London would be reduced by 20–25 per cent and total vehicle miles would be reduced by 10–15 per cent. Car traffic was actually reduced by 33 per cent representing up to 70,000 journeys no longer made by car on a daily basis.

‘Transport For London’ estimates that about half these journeys are now made by public transport; a quarter divert to avoid the zone; 10 per cent have shifted to other forms of private transport including bicycles; 10 per cent have either stopped travelling or changed their time of travel. There have been sharp rises in journeys by bus, taxi and bicycle. Meanwhile, travel speeds have increased by some 17 per cent. The reduction in vehicle usage within the charging zone was greater than expected, leading to less revenue than had been predicted.

The London Congestion Charge appears to have been a political and environmental success. It has encouraged changes in behaviour towards less polluting forms of transport, reducing CO2 emissions. It is also an example of a tax which is flexible, since the rate can be increased or decreased depending on the relative balance of traffic and public transport desired by the city’s residents.

8 Shale gas commons

In 2014, the UK Government announced that councils who support fracking will get to keep 100 per cent of the business rate generated from any shale gas projects in their area. The mining industry will also offer local communities £100,000 for test drilling, and transfer 1 per cent of revenues to them if shale gas is found.

Fracking is strongly supported by the Government (for its potential to bring in new investment, support thousands of jobs and reduce energy bills) and strongly opposed by environmentalists and many local communities (due to potential risks relating to water contamination, earth tremors and other environmental hazards).

Notwithstanding the difference in perspectives, fracking is an example of how the pursuit of the national interest requires action at the local level which is likely to have mainly negative impacts on local areas and communities (the expansion of Heathrow is another example, as is HS2 and nuclear power plants).

In these circumstances, national government has two broad choices. One is to impose the national interest on the local area through the law or regulation, while the second is to offer incentives that encourage and reward local communities to accept the proposed actions. Most commonly, these take the form of financial payments. In the case of fracking the Government has taken the second approach, and local councils (possibly in consultation with local communities) now have to assess whether the ‘value’ of the compensation on offer outweighs the risks that accompany fracking (for economists this is a typical cost-benefit analysis approach).

The decision that each council will make will be determined by a number of factors including: strength of local opinion (for or against); the number of people who could be affected; and, the amount of compensation on offer. Whilst the significance of the first two will depend on the circumstances and priorities of each council, the third criterion can be more objectively evaluated.

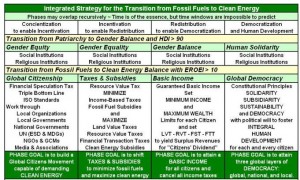

Transition modelling

The transition to sustainability entails maximizing human development and wellbeing as much as possible, and minimizing ecological impacts as much as possible, in a manner that leads to economic and ecological stability. Clearly, maximizing human wellbeing and minimizing ecological impact are mutually contradictory goals as long as human wellbeing is measured in terms of material consumption per capita. Since there are resource limits, and there are limits to efficiency improvements via technological innovation, something must give: humans must adapt by shifting expectations of wellbeing from economic affluence to other human development goals. It is impossible to predict how this adaptation process will unfold, but the following synopsis of the transition phases has been proposed as a point of reference:

The first phase is concientization to enable incentivation. The objective is to create widespread popular support for the required revisions of tax codes and energy subsidies. In other words, the first phase is about creating a collective mindset of global citizenship and social responsibility, strong enough to translate into political will to face the inevitable transition and implement required reforms. Gender equity is key.

The second phase is incentivation to enable redistribution. The objective is to reform tax codes and energy subsidies to expedite the transition from fossil fuels to clean energy. Applicable reforms include shifting taxes from earned income to the usage (extraction) of unearned resources and the release of pollution, as well as taxing financial transactions of dubious social value. Gender equality is key.

The third phase is redistribution to enable democratization. The objective is to institutionalize democracy with gender balance and distributive justice. This may entail adopting a Universally Guaranteed Personal Income (i.e., a basic minimum income rather than a minimum wage) and a Maximum Allowable Personal Wealth (i.e., an upper limit on financial wealth accumulation) that can be democratically adjusted periodically.

The fourth phase is worldwide democratization. The objective is democratization of global, national, and local governance with deeply ingrained gender balance and widely institutionalized implementation of the solidarity, subsidiarity, and sustainability principles. Decisions are to be made at the lowest possible level consistent with governance capabilities and the common good of humanity.

*The four phases are not envisioned to be strictly sequential. They most probably will overlap, with recursions and convulsions along the way.

*The term “gender equality” is not to be understood as “gender uniformity.” By gender equality is meant equality of dignity and personal development opportunities across the entire gender continuum. In other words, full equality in all dimensions of human life: physical, intellectual, psychological, vocational, spiritual.

*The term “clean energy” is to be understood as “clean renewable energy” that is naturally replenished and does not produce GHG emissions when used. It does not include absurdities such as “clean coal.”

*The combination of gender balance and energy balance is hereby proposed as the necessary and sufficient driver for a civilized (i.e., humane) transition, and are expected to have a multiplying effect throughout the global human system.

9 Web references

http://www.sok.bz/web/media/video/ABriefHistoryNeoliberalism.pdf

http://www.pelicanweb.org/solisustv08n03supp3.html

http://www.vedegylet.hu/okopolitika/Dobson_Thinking_about_ecologism.pdf

http://www.feasta.org/documents/review2/robertson.htm

http://www.jamesrobertson.com/book/monetaryreform.pdf

http://www.bris.ac.uk/education/people/academicStaff/edslr/publications/17slr

http://www.jamesrobertson.com/article/freelunches.htm

http://www.jamesrobertson.com/futuremoneyreviews.htm

http://www.eurozine.com/articles/2012-08-29-robertson-en.html